www.frederick.edu

www.frederick.edu

• 301.846.2400 33

2018/2019 fcc catalog

III. International and Foreign National

Students

A. A foreign national lawfully eligible for study in

the United States may be considered a resident

for tuition purposes if he/she meets the domicile

requirements stated in this procedure. A foreign

national lawfully admitted to the United States on

a visa type with a corresponding "date-certain"

authorized stay may not be considered a resident

for tuition purposes. A foreign national lawfully

eligible for study in the United States on certain

visa types with an indeterminate authorized stay

may be considered as a Maryland resident for

tuition purposes, if the domicile requirements of

this procedure have been satisfied.

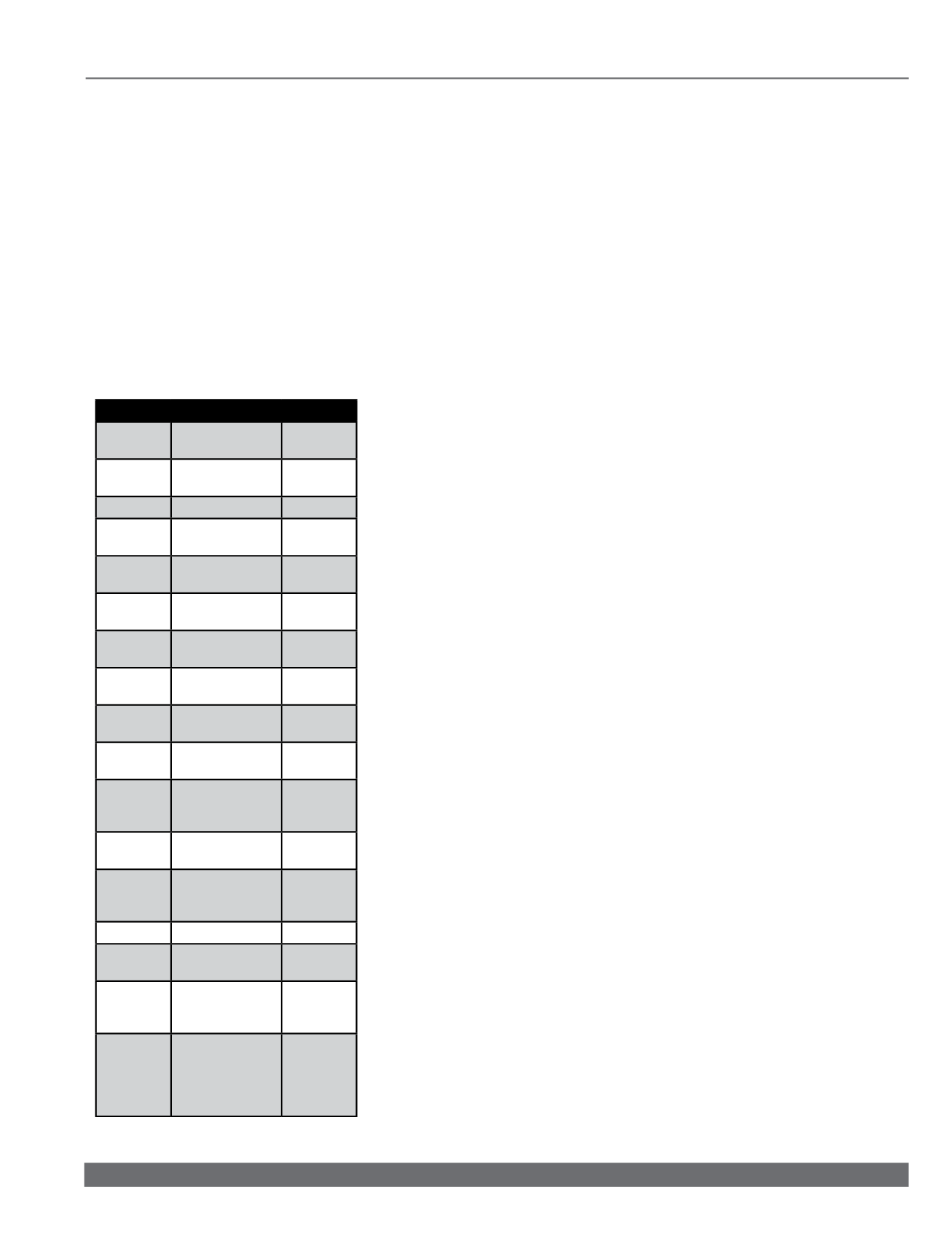

B. The following visa status types determine

residency as indicated:

Visa

A

Diplomats, family,

staff

In-County

B

Temporary visitor

See (c)

below

C

Aliens in transit

Out-of-State

E

Treaty trader-

Taiwan only

In-County

F

Student and

dependents

Out-of-State

G

Representative of a

world organization

In-County

H1 or H4

Temporary worker

and dependents

In-County

H2 or H3

Other specialty

workers

Out-of-State

I

Foreign media/

journalist

In-County

J

Exchange visitor,

Au pair, scholar

Out-of-State

K

Fiancé of U.S.

citizen/Frederick

County resident

In-County

L

Intra-company

transferee

In-County

M

Foreign vocational

student,

dependents

Out-of-State

R

Religious worker

In-County

TN

Professionals under

NAFTA agreement

Out-of-state

V

Spouse or child

of permanent

resident

In-County

Permanent

Resident;

Green Card;

Refugee,

Asylee

In-County

C. Individuals in “B Temporary Visitor Status” are not

allowed to engage in a course of study leading

to a degree or academic certificate. In certain

cases, B visa holders can participate in courses

which are recreational and do not lead to a

degree. Out-of-state tuition rates will apply.

D. Students who are in the category of “Deferred

Action Childhood Arrivals” (DACA), or “Temporary

Protected Status” (TPS) are eligible to establish

in-state/in-county residency for tuition purposes.

E. In-county residency status for eligible

“International/Foreign National Students”

must meet the same three (3) months

requirements and proof of residency

documents as all other students.

F. An individual’s immigration status may not

preclude award of MD residency under this policy

if the individual has the legal capacity to establish

domicile in Maryland.

IV. Dream Act

A. Students who have met the eligibility

requirements outlined in the Maryland Dream

Act will be granted the opportunity to receive

in-county tuition. The student must present an

affidavit to the Admissions Office stating that

he/she will file an application to become a

permanent resident within 30 days of becoming

eligible to do so.

B. Students who live in Frederick County or in

Maryland, and qualify for in-county or in-state

tuition, as outlined by the Maryland Dream Act,

will remain undocumented immigrants. U.S.

residency status is processed, determined and

completed by the U.S. government.

V. Proof of Residency

In accordance with Maryland State and Federal

Law, any of the following factors will be considered

to be proof of legal residency:

A. Substantially uninterrupted physical

presence, including the months when the

student is not in attendance at the college,

as evidenced by ownership or rental

of living quarters in which the student

resides. (12-month lease or mortgage)

B. Payment of Maryland state and local income

taxes. (MD 502 Tax Form)

C. Registration to vote in Frederick County and/or

the state. (Voters Registration Card)

D. Registration of a motor vehicle in the state, with

a local address specified, if the person owns

such a vehicle. (Motor Vehicle Registration Card)

E. Possession of a valid Maryland driver's license,

with a local address specified, if the person is

licensed anywhere to drive a motor vehicle, or a

valid Maryland MVA-issued ID. (Driver's license

or MVA issued ID card)

F. Active duty military personnel, honorably

discharged veterans, spouses and dependents

who reside, are stationed, or domiciled in

Maryland are exempt from the 3-month

requirement and are considered in-county

once proof is shown. (Military orders, letter

from Education Officer, DD214 and any of the

residency factors listed above).

VI. Reclassification of Residency

A. Students requesting reduced tuition rate based

on a change in residency must submit proof

of actual address change as defined in Section

V to the Admissions Office and complete the

“Change of Address” form available either online

at

www.frederick.eduor in the Admissions

Office in Jefferson Hall, Suite 101. The proof of

residency and “Change of Address” form must

be submitted in one of the following ways:

1. in-person to the Admissions Office

in Jefferson Hall, Room 101,

2. online through personal “myFCC” email

account to

[email protected]3. by fax (240-629-7896), or

4. via U.S. postal mail.

B. Request for change in residency classification

must be submitted prior to the “last day

to add” for the first session for which the

student is enrolled in order to be changed

for that session. Residency is not retroactive.

A student who changes his/her residency

during a semester and provides proof after

the “last day to add” will have their residency

adjusted for the following semester.

C. In order to comply with USPS regulations

regarding bulk and pre-sort mailings, the

College verifies current addresses of students

with the National Change of Address (NCOA)

listing every 90 days. If there has been a

change of address, the student will be

notified by email and tuition will be adjusted

for the following semester as follows:

1. A student moving to a higher tuition

rate based on their residency will have

their residency automatically changed

to reflect their new residency status.

2. A student moving to a lower tuition rate

based on their residency will bear the burden

of proof of the new residency status.

The College’s official version of the Residency Policy

& Procedures is on its website (

www.frederick.edu)

and may be revised annually.

In-county Tuition Rate for Employees of Frederick

County Business & Industry

FCC offers an agreement that allows employees

of Frederick County businesses to take classes at

in-county tuition rates. For details, please call the

Student Accounts Office at 301.846.2456.