2019 - 2020 FCC Academic Catalog

54

www.frederick.edu• 301.846.2400

www.frederick.edu• 301.846.2400 55

2019 - 2020 FCC Academic Catalog

Effective summer 2019, most credit courses have been renumbered.

The former course numbers are listed in the course descriptions when

applicable. A reference document of the old and new course numbers can

also be found on the web at

https://www.frederick.edu/class-schedules.aspx?cid=schedules-top-link.

Accounting

A.A.S. Degree (Career)

Designed to prepare students for immediate employment in the accounting field

in an entry-level professional position. Students will gain an in-depth knowledge

of accounting principles and procedures and apply them to business situations.

Students will also use application software to solve business and accounting

problems. A grade of “C” or better must be earned in the following courses: ACCT

100, ACCT 101, ACCT 201, ACCT 202, ACCT 233 and ACCT 111. (Transfer students

should follow the business administration program.)

• Students must complete their credit

English and Mathematics

within the first

24 credits.

• One course must meet the

cultural competence graduation requirement.

• CORE: The General Education CORE

is that foundation of the higher education

curriculum providing a coherent intellectual experience for all students. Students

should check with an advisor or the transfer institution (ARTSYS) before selecting

General Education CORE requirements.

http://artsys.usmd.edu/• In some General Education categories (Mathematics, Biological & Physical

Sciences), a 4-credit course selected from the GenEd course list will satisfy the

requirement in place of a 3-credit course. Students should check with an advisor

before selecting these courses.

• For the PE/Health & Nutrition requirement, a 3-credit Physical Education or Health

course may satisfy the requirement in place of a 1-credit course. Students should

check with an advisor before selecting this course.

• Students must earn a grade of "C" or better in ENGL 101.

Course

Credits

English

ENGL 101 English Composition

3

Mathematics

Mathematics Elective (GenEd course list) (MATH 125 recommended)

3

Social & Behavioral Sciences

HUMS 102 Human Relations (satisfies cultural competence requirement) 3

Arts & Humanities

Communications Elective (GenEd course list)

3

Biological & Physical Sciences

Biological & Physical Sciences Elective (GenEd course list)

3

Interdisciplinary & Emerging Issues

CMIS 101 Information Systems and Technology

3

General Education Elective

ECON 201 Principles of Macroeconomics or

PHIL 208 Business Ethics

3

Physical Education, Health, or Nutrition Requirement

(Select one PHED, HLTH, or NUTR course)

1

Departmental Requirements

ACCT 100 Business Accounting

3

ACCT 101 Principles of Accounting I

3

ACCT 102 Principles of Accounting II

3

ACCT 111 Computerized Accounting

3

ACCT 201 Intermediate Accounting I

4

ACCT 202 Intermediate of Accounting II

4

ACCT 203 Managerial Cost Accounting

3

ACCT 233 Applied Accounting

3

ACCT 117 Payroll Accounting or

ACCT 205 Federal Income Tax Accounting or

ACCT 216 Governmental and Not-For-Profit Accounting

3

BMGT 103 Introduction to Business

3

BMGT 120 Business Communications

3

CMIS 111E Spreadsheets

3

60

Transfer Note: For more information on careers and transfer, contact the Counseling & Advising office at 301.846.2471 or visit the Programs web page.Business Accounting

Certificate (Career)

Prepares students working in the accounting field for career advancement

opportunities. Students will gain an in-depth knowledge of accounting principles

and procedures and apply them to business situations. Students will also use

application software to solve business and accounting problems. A grade of “C” or

better must be earned in the following courses: ACCT 100, ACCT 101, ACCT 201,

ACCT 202, ACCT 233 and ACCT 111.

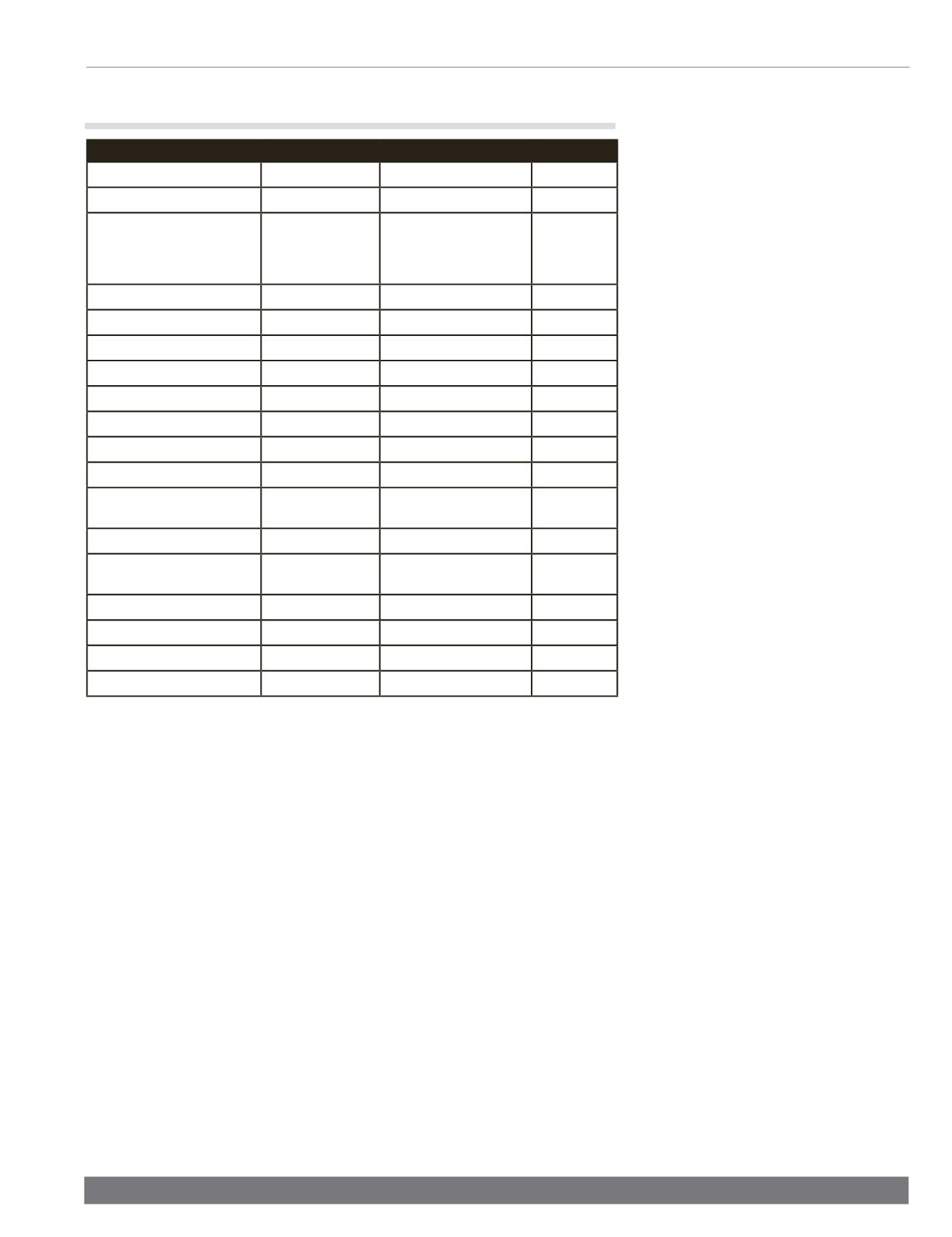

Course

Credits

Departmental Requirements

ACCT 100 Business Accounting

3

ACCT 101 Principles of Accounting I

3

ACCT 102 Principles of Accounting II

3

ACCT 111 Computerized Accounting

3

ACCT 201 Intermediate Accounting I

4

ACCT 202 Intermediate of Accounting II

4

ACCT 203 Managerial Cost Accounting

3

ACCT 233 Applied Accounting

3

ACCT 117 Payroll Accounting or

ACCT 205 Federal Income Tax Accounting or

ACCT 216 Governmental and Not-For-Profit Accounting

3

BMGT 103 Introduction to Business

3

BMGT 120 Business Communications

3

CMIS 101 Information Systems and Technology

3

CMIS 111E Spreadsheets

3

41

Transfer Note: For more information on careers and transfer, contact the Counseling & Advising office at 301.846.2471 or visit the Programs web page.Credit Programs of Study

Computerized Accounting

Certificate (Career)

Prepares students for immediate employment in the accounting field in a support

position. Students will learn how to apply accounting concepts in a computerized

environment to assist the business with their record keeping requirements. A

grade of “C” or better must be earned in the following courses: ACCT 100, ACCT

101, ACCT 111.

Course

Credits

Departmental Requirements

ACCT 100 Business Accounting

3

ACCT 101 Principles of Accounting I

3

ACCT 102 Principles of Accounting II

3

ACCT 111 Computerized Accounting

3

ACCT 117 Payroll Accounting or

ACCT 205 Federal Income Tax Accounting or

ACCT 216 Governmental and Not-For-Profit Accounting

3

BMGT 120 Business Communications

3

CMIS 101 Information Systems and Technology

3

CMIS 111E Spreadsheets

3

24

Transfer Note: For more information on careers and transfer, contact the Counseling & Advising office at 301.846.2471 or visit the Programs web page.Accounting

Letter Of Recognition (Career)

Provides students with basic accounting and computer skills including recording

transactions using generally accepted accounting principles, preparing financial

statements, and using a computerized accounting system.

Course

Credits

Departmental Requirements

ACCT 100 Business Accounting

3

CMIS 101 Information Systems and Technology

3

ACCT 111 Computerized Accounting

3

9

CPA Exam Qualification

Certificate

The state of Maryland requires candidates for the Uniform CPA examination

to have completed 150 college credits and obtained a bachelors degree in

any area of study. As part of the 150 credit hour requirement, candidates must

complete specific courses in accounting, business related subjects, and ethics as

described in state regulations. This certificate is designed for students who have a

baccalaureate degree and need to complete the additional course requirements

to sit for the CPA exam in Maryland.

Course

Credits

Requirements

I. Accounting and Ethics Education - 32 credit hours

ACCT 100 Business Accounting

3

ACCT 101 Principles of Accounting I

3

ACCT 102 Principles of Accounting II

3

ACCT 201 Intermediate Accounting I

4

ACCT 202 Intermediate Accounting II

4

ACCT 203 Managerial Cost Accounting

3

ACCT 205 Federal Income Tax Accounting

3

ACCT 214 Auditing

3

ACCT elective (recommend ACCT 216 Governmental

and Not-For-Profit Accounting)

3

PHIL 208 Business Ethics or

PHIL 105 Ethics

3

32

II. Business Related Education - 21 credit hours required

from six of the following seven groups

Group 1: Statistics

MATH 120/MATH 120A Statistics or

MATH 125 Business Statistics

3

Group 2: Economics

ECON 201 Principles of Macroeconomics

3

ECON 202 Principles of Microeconomics

3

Group 3: Management

BMGT 227 Principles of Management

3

Group 4: U.S. Business Law

BMGT 211 Business Law

3

Group 5: Marketing

BMGT 225 Marketing

3

Group 6: Business Communication

BMGT 120 Business Communications

3

Group 7: Computer Information Systems

CMIS 101 Information Systems and Technology

3

21

53

Transfer Note: For more information on careers and transfer, contact the Counseling & Advising office at 301.846.2471 or visit the Programs web page.